Back to Trade Signals

market-updatetrading-signal

Commodities - Weekly Update #2

Commodities - Weekly Update #2 - Read the full update on Zelf Trade.

LR Guizado•

Commodities - Weekly Update #2

July's monthly close

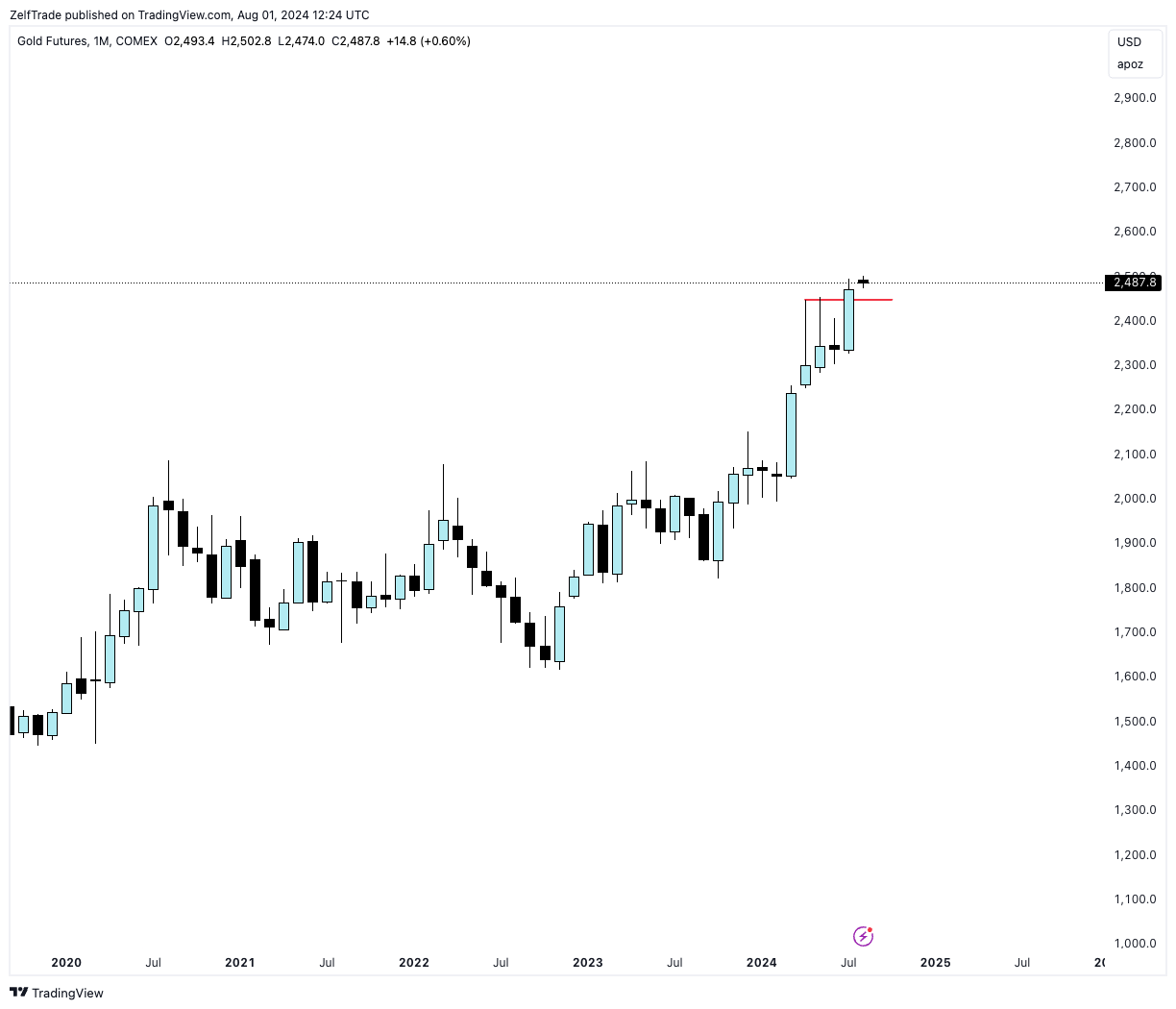

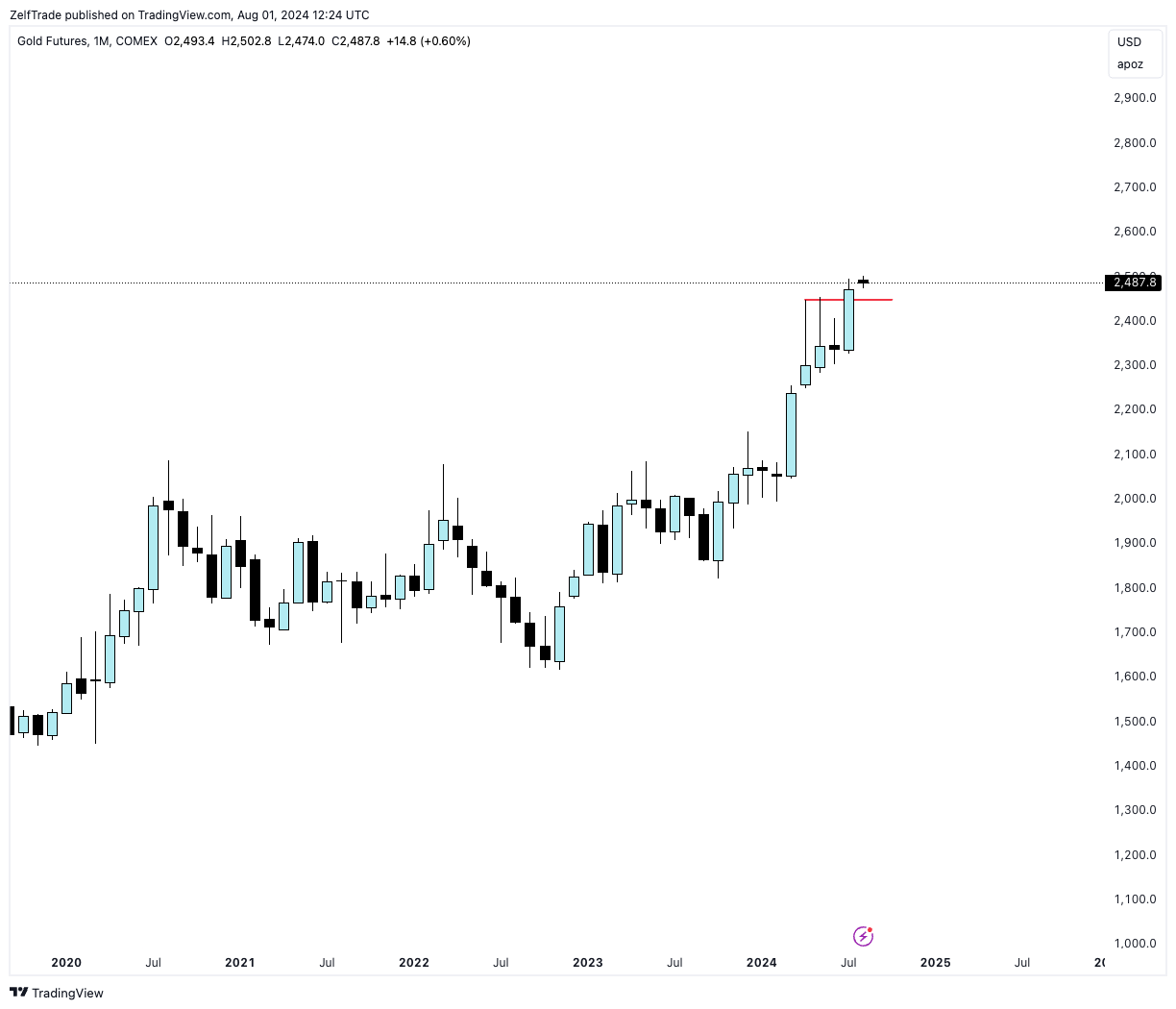

Gold (XAU)

Perfect monthly close with a bullish expansive bar closing above previous all time high signaling bullish strength.

On our last weekly update we posted this setup long on $2,360 and we had a nice 4% long swing from entry. Previous report click HERE.

A retrace towards $2,380 could still be in play but honestly no interest in getting this steep retrace. Would rather see price trending higher first and taking the highs of $2,485 first, before a retrace. Only time will tell, so far we are bullish MACRO and SHORT TERM.

Silver (XAG)

Nothing interesting in the monthly close. From a macro perspective silver is bullish but SHORT TERM it looks like a retrace’s incoming. WATCH OUT…

Break above $29.7 for a scalp swing long target $31’s.

Or short entry at market price to target $26.5

Corn (ZC)

There is a monthly bearish trend that is set to expire in November this year.

July’s monthly chart, closed with a bearish full body candle showing bears are in control. Not much to do here from a macro perspective. $340’s should be on the way.

On our last update we posted a long setup which unfortunately was invalidated. Everything was starting to align for a short term bounce but price action didn’t go along and we got stopped out.

We could still see a bounce $400+ but for now this is a NO TRADE.

Sugar (SB)

We broke the bullish market structure on a higher time frame. Price is making higher highs and we are currently at the best risk rewards area. Previous low of $17.20 must remain untapped for bullish continuation. If we do break $17 then most likely we’ll be expecting a retrace towards the $14 price range but for now it looks great MACRO.

Below link for complete sugar report entries and short term predictions.

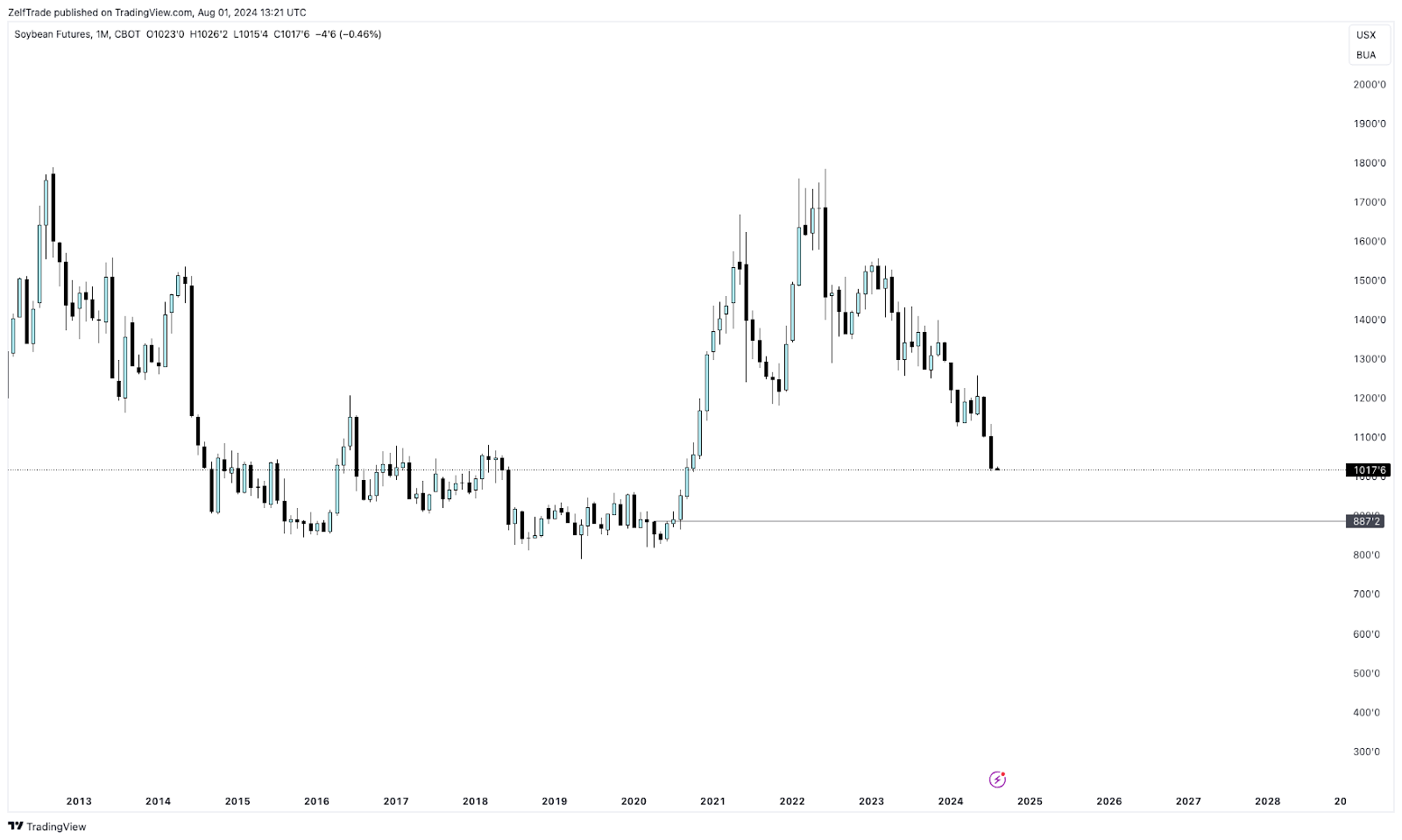

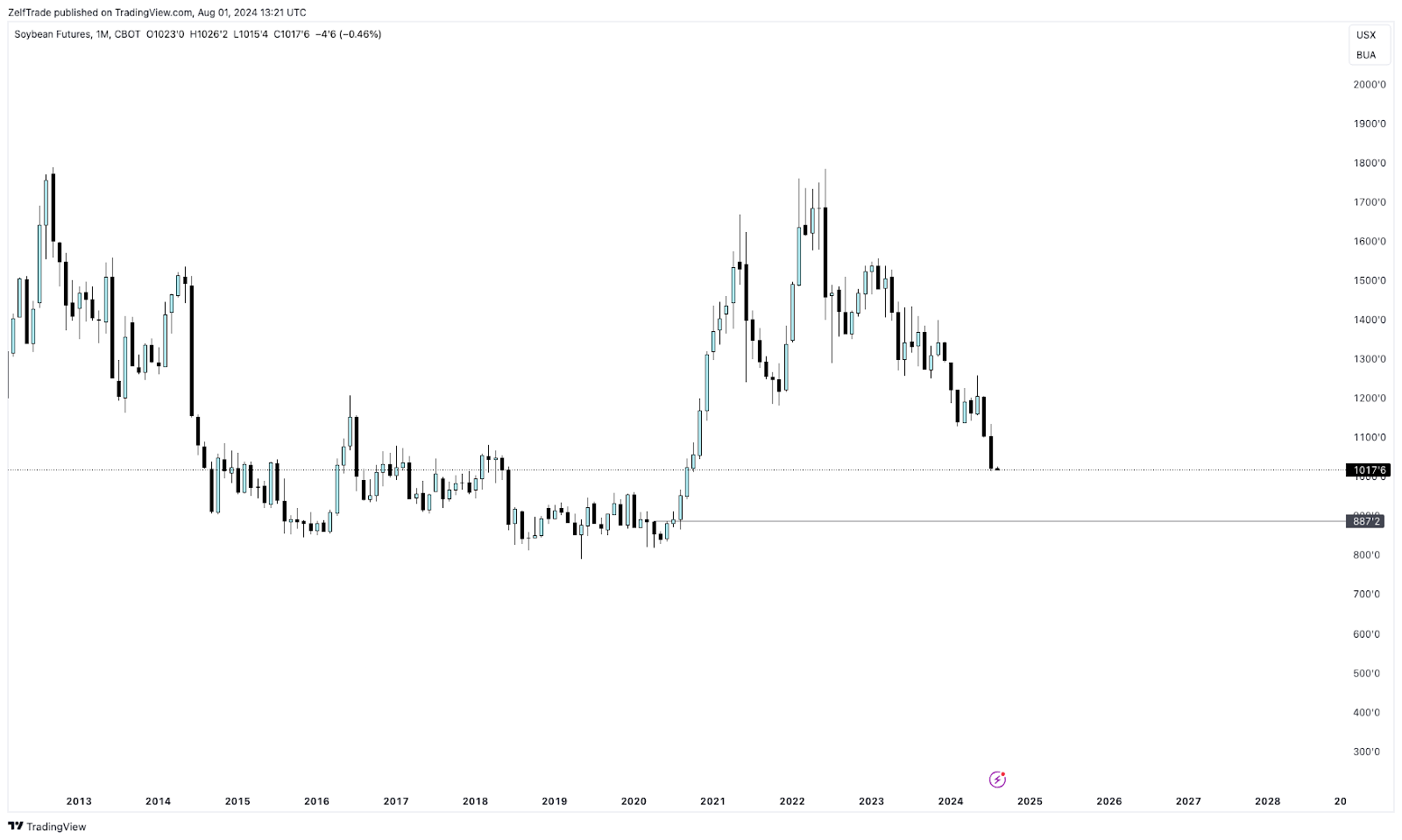

Soybean (ZS)

Horrible monthly close showing more blood to come.

Free fall to $880 - $850’s on its way.

Wheat (ZW)

Bearish monthly close BUT…. THERE’S HOPE.

On the daily timeframe price seems to have found a temporary bottom at $520’s after taking liquidity off the previous low. For now it’ll be too risky to jump in long but if price’s able to trade back above $555 its GAME ON.

Disclaimer

Not financial or tax advice. Zelf Trade is not a financial institution. No content on this Newsletter is financial, accounting, legal or tax advice. Zelf Trade content is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclaimer: This content was originally published on Zelf Trade.