Back to Blog

scam-alertczdexwash-tradingtransparency

The Aster DEX Scandal: Fake Volume and the CZ Connection

Allegations surface that CZ backed a fake DEX called Aster to undercut competitors. With 70% of supply in 5 wallets, is this another lesson in centralized deception?

Miguel Treviño•

TL;DR:

- The Controversy: Aster DEX is accused of being a centralized puppet for CZ, using wash trading to fake its success.

- The Evidence: Trading volume perfectly mirrored Binance data, and 70% of the token supply is held by just 5 wallets.

- The Red Flag: DefiLlama delisted Aster because it couldn't provide verifiable data, proving that "DEX" labels can hide centralization.

- The Protection: Zelf prioritizes on-chain transparency and ZK-identity to prevent bot farming and ensure true self-custody.

In the world of crypto, "decentralized" often just means "hidden centralization." A new controversy has erupted surrounding Aster, a so-called decentralized exchange (DEX) that allegedly served as a puppet for former Binance CEO Changpeng Zhao (CZ).

The Allegations: Rage, Jealousy, and fake Volume

According to reports from crypto investigators, Aster was created not out of innovation, but out of spite. The narrative suggests that CZ, threatened by the rise of legitimate DEXs like Hyperliquid, backed Aster to manufacture a competitor.

But the "success" of Aster appears to have been a mirage.

1. Mirroring Binance Volume

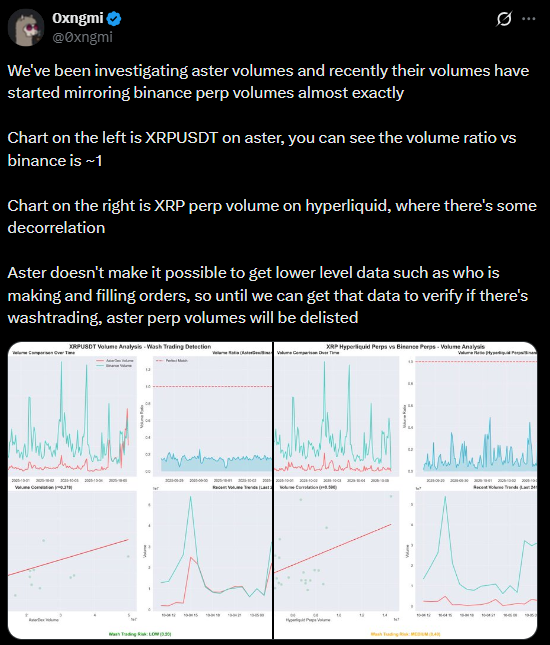

Investigators noticed something suspicious: Aster's trading volume was an almost perfect mirror of Binance's perpetual pairs.

Real organic volume moves independently. When a "DEX" perfectly correlates with a CEX's internal data, it strongly suggests wash trading—bots trading back and forth to create the illusion of activity.

2. The DefiLlama Delisting

The manipulation was so blatant that DefiLlama, the industry standard for DeFi data, took the extraordinary step of delisting Aster entirely. They refused to track a platform that couldn't provide verifiable API data to prove its volume was real.

3. Supply Control

Perhaps most damning is the token distribution. Over 70% of Aster's token supply sits in just 5 wallets. This isn't a decentralized community project; it's a centralized scheme waiting for a rug pull.

The Lesson: "Trustless" is a misnomer without verification

This scandal highlights a critical flaw in how we evaluate crypto projects. We see a "DEX" label and assume it's safe. But code can be centralized, volume can be faked, and liquidity can be pulled.

If you can't verify the chain, you are just trusting another human.

How Zelf Protects You

Zelf is built on the premise that transparency is non-negotiable.

- True Decentralization: Zelf doesn't run "shadow" order books. What you see on-chain is what exists.

- Identity without Doxing: Our ZK-proof identity layer ensures that real humans are participating in the ecosystem, making it much harder for wash-trading bot farms to operate undetected.

- Self-Custody: You never have to wonder if a "team wallet" holds all your funds. You hold them.

The Aster saga will likely go down in history as a warning: Just because it's called a DEX doesn't mean it's not a rig.

Don't get washed. Get verified with Zelf.